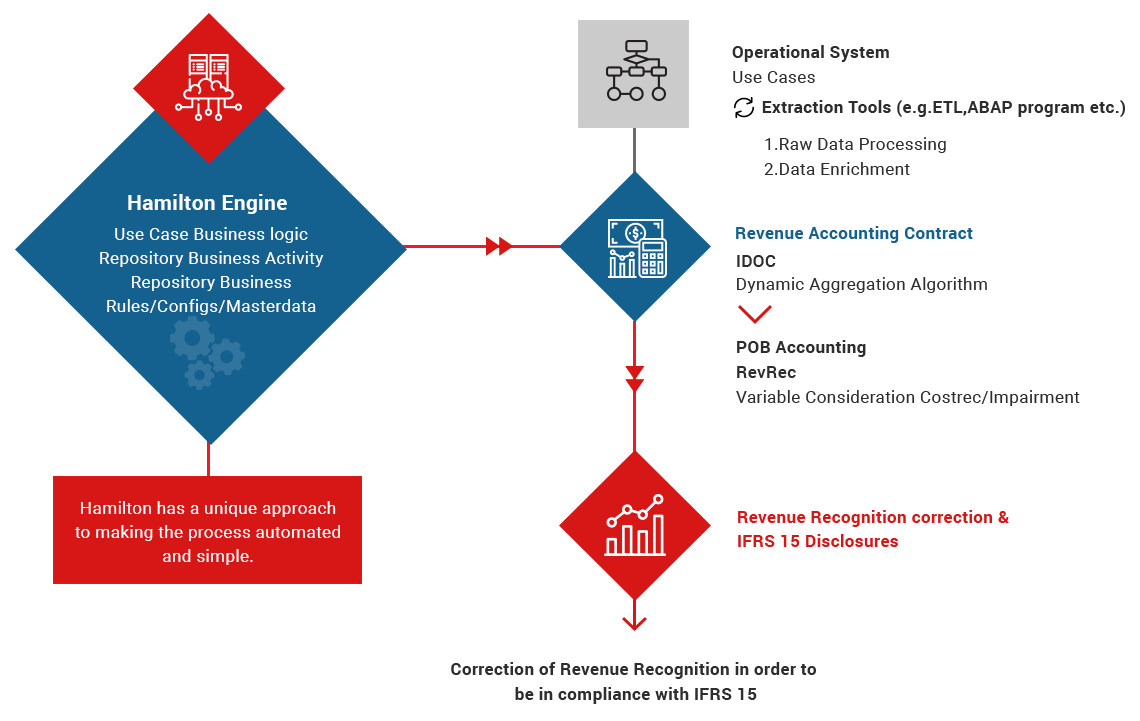

Hamilton has built-in functionality that solves both the IFRS 15/ASC 606 and IFRS 16/ASC 842 regulatory needs. The Automated Accounting Framework is designed to adapt to future requirements as well. No matter what regulatory changes arise in the future, Hamilton’s flexible, robust, and use-case-driven core technology will always be able to support you and your business.

The Hamilton Revenue Compliance

(IFRS 15 and ASC 606) Solution Supports:

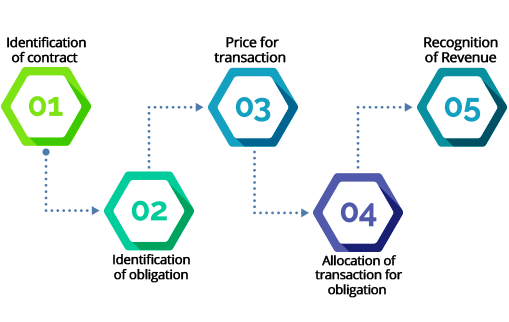

IFRS 15 is a puzzle that can’t be solved by accounting teams and spreadsheets alone. We’re here to help. Adapting a business and its operations to IFRS 15 is what we do. All companies, both public and private, are required to prepare their revenue contracts in compliance with IFRS 15 and ASC 606.

The Hamilton

Lease Accounting & Compliance

(IFRS 16 and ASC 842)

Hurry up and get ready. By 2019, virtually all businesses in the leasing ecosystem must have solutions in place to meet the new standards for lease accounting: IFRS 16 and ASC 842, which were issued in 2016 by the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB).

-

Invest Wisely

Hamilton is a comprehensive solution for lessors and lessees that is designed to shorten the implementation process, create efficiencies, and assure long-term compliance with current and future accounting standards.

-

Robust Capabilities

Choose Hamilton to for lease administration, lease accounting and compliance, or both. It supports lease contract creation and management and every accounting feature you can think of, from classification, accruals, and payments to business document generation, disclosure, and reporting.

-

Now and Forever

The Hamilton solution is really a framework, powerful enough to automate all your business’s accounting processes and flexible enough to keep you in compliance with IFRS 16/ASC 842 and all future lease accounting standards.